how to get help with delinquent property taxes

To help property owners manage their taxes and regulate debts DoNotPay created a practical feature. Owners with a tax lien on their property are left with a few options.

Delinquent Property Tax Re Elect Larry Roberts

Determine the cost could be free or up to 500.

. The Tax Collectors Public Service Office located at 200 NW 2nd Avenue Miami Florida 33128 is open Monday through Thursday from 830 am. A tax deed application may. Open DoNotPay in a web browser Choose the Reduce Property.

Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney. Some counties will and others charge a. The IRS explains that the best way to discharge a lien is to repay the delinquent taxes in full.

Delinquent Property Tax payments may be mailed to the Milwaukee County Treasurers Office at the following address. Many governments offer financial support for certain scenarios. About You may request a price quote for state-held tax delinquent property by submitting an electronic application.

Ask your county treasurer for the tax delinquent list. How to Get Help Paying Your Property Taxes When You Are Behind. Ask for a Payment Plan.

You have a few options when you are dealing with delinquent property taxes. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. If the property owner fails to pay delinquent taxes within two years from the date of delinquency the tax certificate holder investor may file a tax deed application.

They are often called. The first thing to do is contact your city or the county treasurer to see if they will give you the list for free. Find how to get help with delinquent property taxes including information on installment plans.

Once your price quote is processed it will be emailed to you. Fill out and complete an application for a loan online. And on Fridays from 830 am.

Wait for our team to go over your provided. Follow the steps shown below and youll receive delinquent property tax help in no time. The county treasurer and any tax collectors who do not return unpaid taxes to the county treasurer provide data on delinquent homeowners to the county real property tax RPT.

Apply for a payment plan through the property tax office. Milwaukee County Treasurer 901 N. However this is easier said than.

The first and most obvious choice would be to pay them back. Mail a check to the treasurers office with a letter of instruction. A lawyer may be able to help a homeowner enter into a payment program.

So how do You Get the Tax Delinquent List. 9th St Room 102 Milwaukee WI. When Your Property Taxes Are Delinquent Get Help From Tax Ease If your property taxes are delinquent start by completing our simple online loan application with no credit check.

Here is how it works. The Tax Office accepts full and partial payment of property taxes online.

Finding Tax Delinquent Properties In Your Area Than Merrill

Delinquent Personal Property Tax Bill

Help My Mortgage Company Paid My Past Due Property Taxes

Tarrant County Residents Can Get Help With Delinquent Property Taxes Fort Worth Report

Pay Property Taxes Or Obtain Tax Bill Information Yolo County

New Texas Program Offers Homeowners Assistance Funds For Delinquent Mortgage Payments Property Taxes Community Impact

Secured Property Taxes Treasurer Tax Collector

Solved Research Case Delinquent Taxes And Tax Liens L04 1 Chegg Com

How Detroit Homeowners May Finally Rid Themselves Of Tax Foreclosure Outlier Media

Delinquent Property Taxes Understanding Property Tax Delinquency Tax Ease

Wholesaling Tax Delinquent Properties Ultimate Guide For Investors

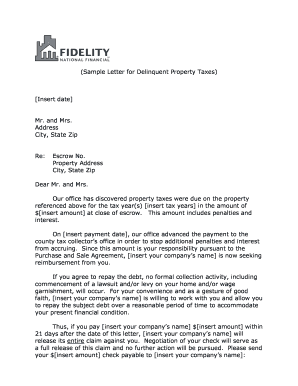

Delinquent Property Tax Letter Samples Fill Online Printable Fillable Blank Pdffiller

Texas Delinquent Property Tax Laws A Guide To Help With Delinquent Property Taxes In Texas Tax Ease

Foreclosure Counseling Southwest Solutionssouthwest Solutions

Tax Break Seeking Health Club Kingpin Delinquent On At Least 549 000 In Property Tax Payments Kansas Reflector

Texas Delinquent Property Tax Laws A Guide To Help With Delinquent Property Taxes In Texas Tax Ease

Loophole Adds Up To Profits For Property Tax Buyers Study

Dallas County Announces Assistance For Delinquent Property Taxes People Newspapers